Real estate advertising trends Q2 2023

Share

Schedule a 30-min marketing strategy call with our team

Get the inside scoop on the latest real estate advertising trends! Our new report uncovers major shifts in Google, Facebook, and Instagram ads during Q2 2023. We break down these trends with data spanning from January 2021 to June 2023 to see how today’s shifting market is affecting digital advertising.

Executive summary

The Q2 2023 national residential real estate landscape has been predominantly marked by a slight decline in home prices, instigated by a multitude of factors including rising mortgage rates, an inflationary macro-economic environment, and substantial economic uncertainty.

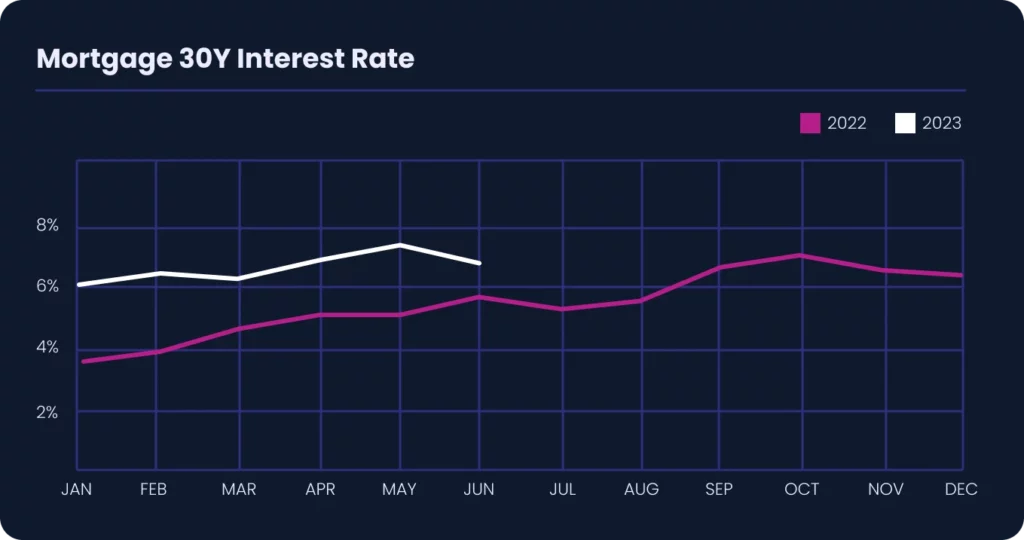

The US national median home price fell by 1.2% to $317,496, as home values fell in roughly 80% of the largest housing markets. This decline in prices has been propelled by a jump in the average 30-year fixed-mortgage rate from 3.85% in January 2022 to 6.85% in June 2023.

Although inflation rates have decreased to 5.7% in Q2, there remains a strain on household budgets due to inflation. This combined with economic uncertainty stemming from the international crises with the Ukraine war and the ongoing COVID-19 pandemic began to foster lingering financial caution, contributing to a declining Q2 in the residential home resale market.

Given this macroeconomic context on the US housing market, our objective with this report is to provide an analytical summary of recent Google and Meta (Facebook and Instagram) real estate advertising trends, leveraging a comprehensive dataset spanning from January 2021 to June 2023.

We’ve again combed through our proprietary data, one of the largest sets of paid marketing data in the US residential real estate industry, to glean aggregated and anonymized insights for you. We hope these insights help inform your strategic decision-making as you navigate a real estate market going through a period of significant uncertainty. You may spot some unexpected potential positive signs, as we did.

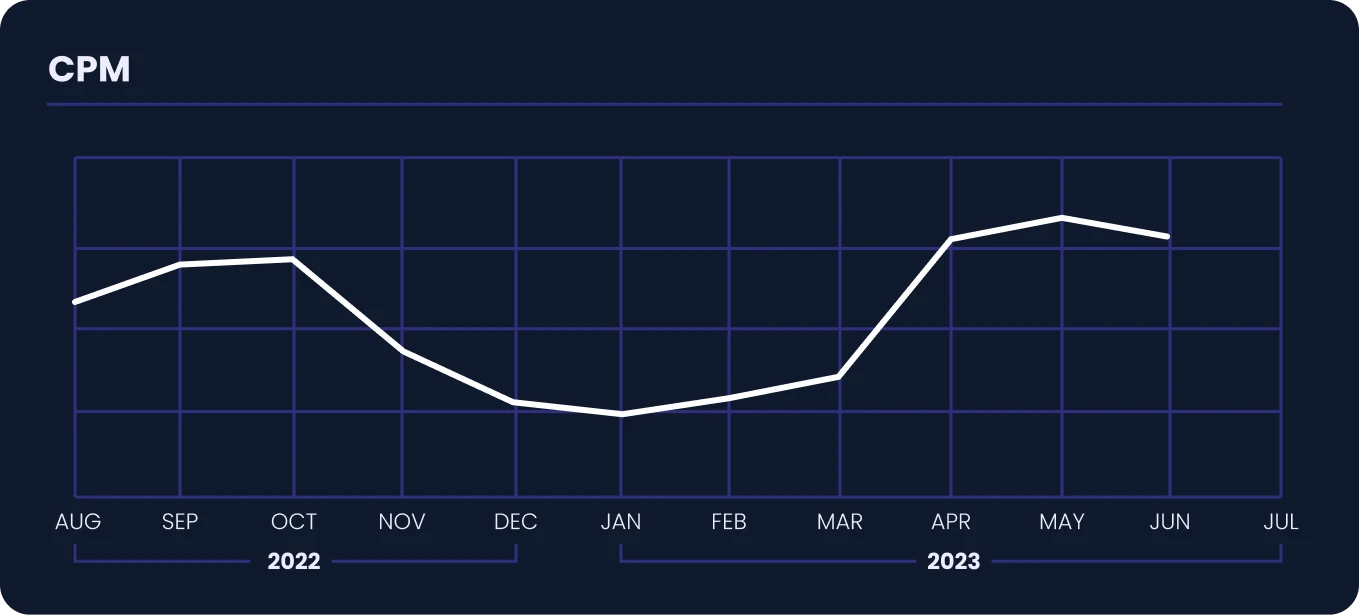

Shifting mortgage interest rates

Before diving into the data of real estate advertising trends on Google and Meta, below is a graph comparing 30-year mortgage interest rates in 2022 through Q2 of 2023. The rates experienced a steady increase throughout 2022, indicating a shift in the housing market. These changes not only impact buyers and sellers on the ground, but they also impact the preferences and actions of potential homebuyers online, prompting adjustments in digital advertising campaigns on Google and Meta platforms to effectively engage this evolving audience.

Recognizing the relationship between interest rates and digital advertising trends enables real estate professionals to adapt their strategies and optimize their marketing impact amidst a changing market landscape.

Facebook & Instagram

Annualized advertising trends

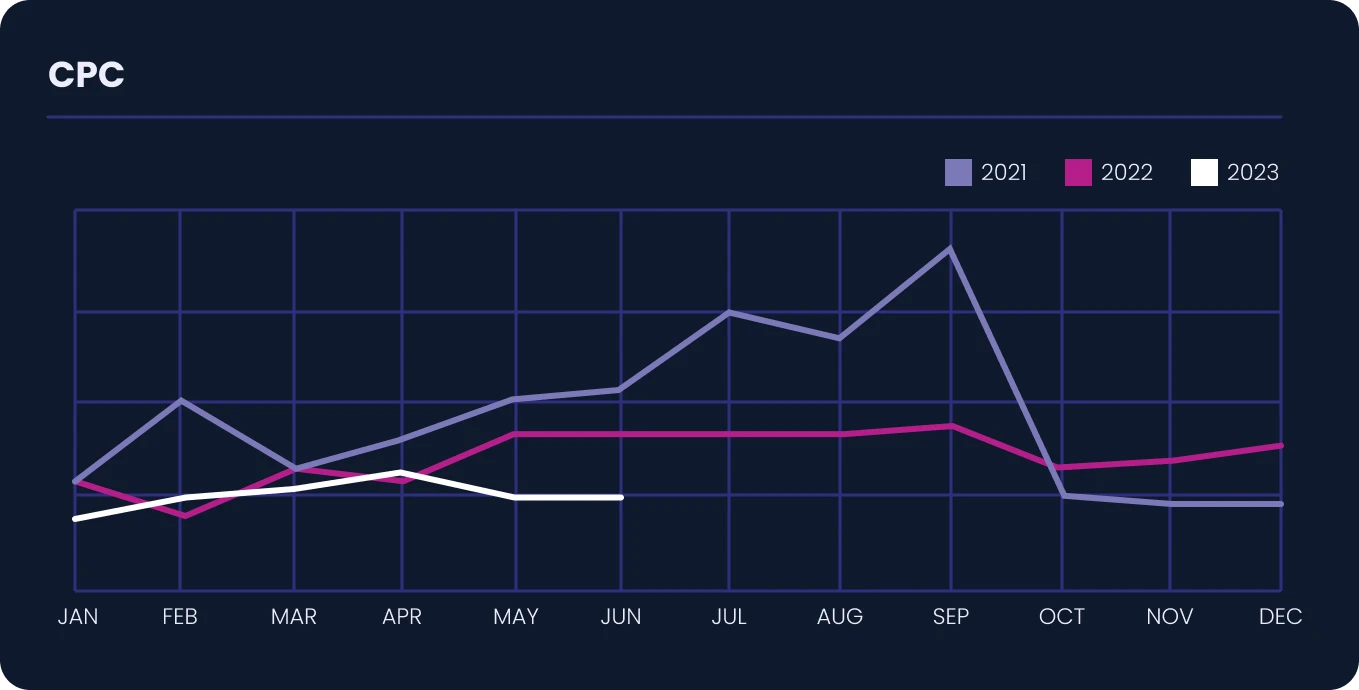

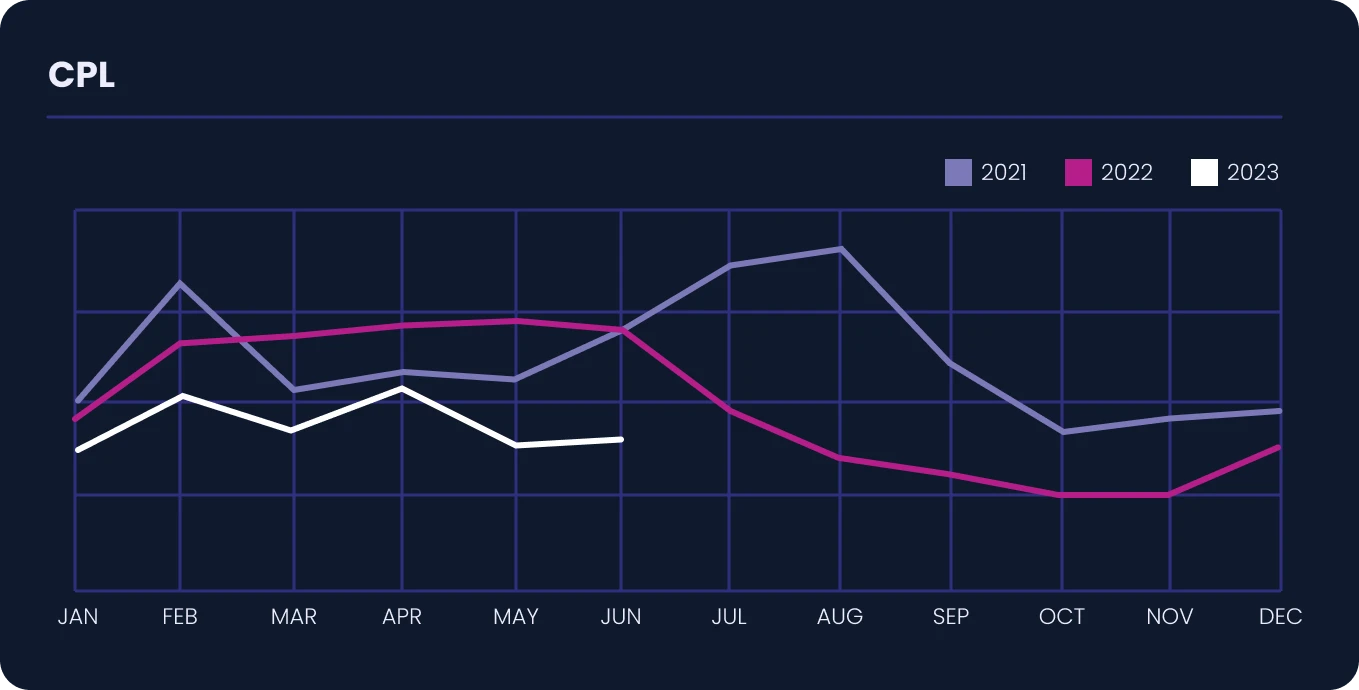

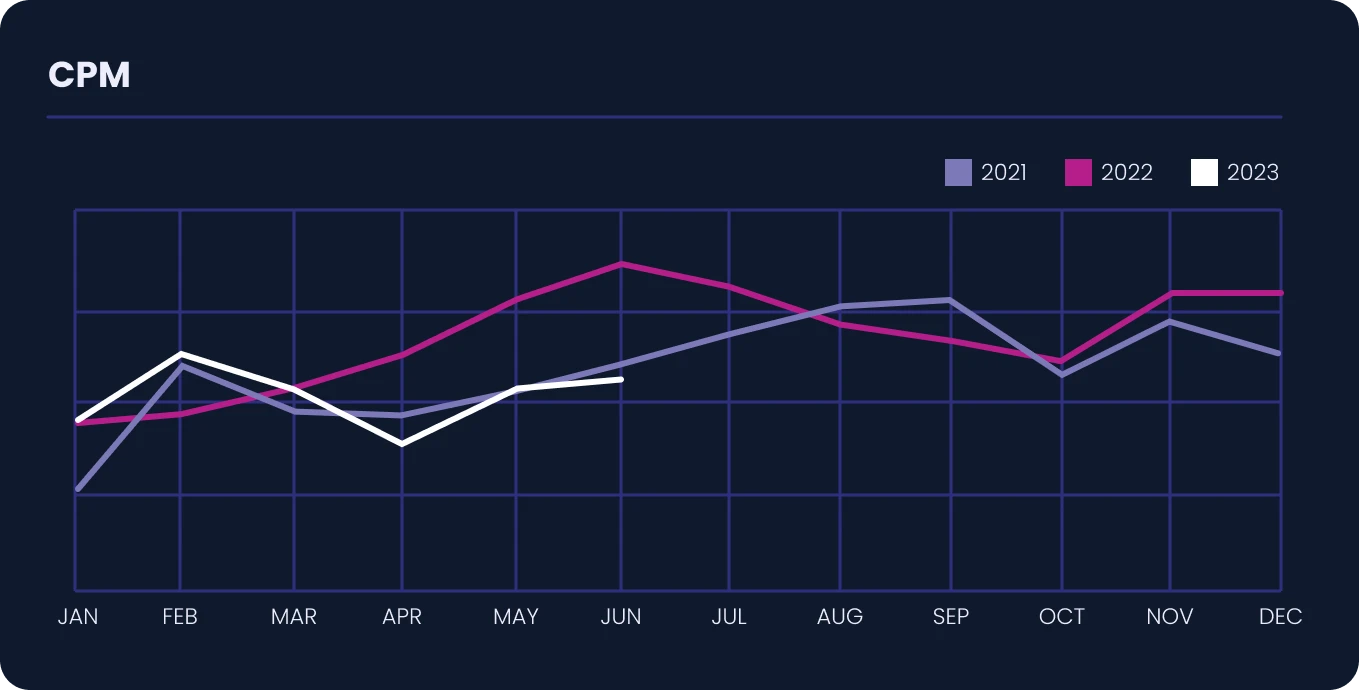

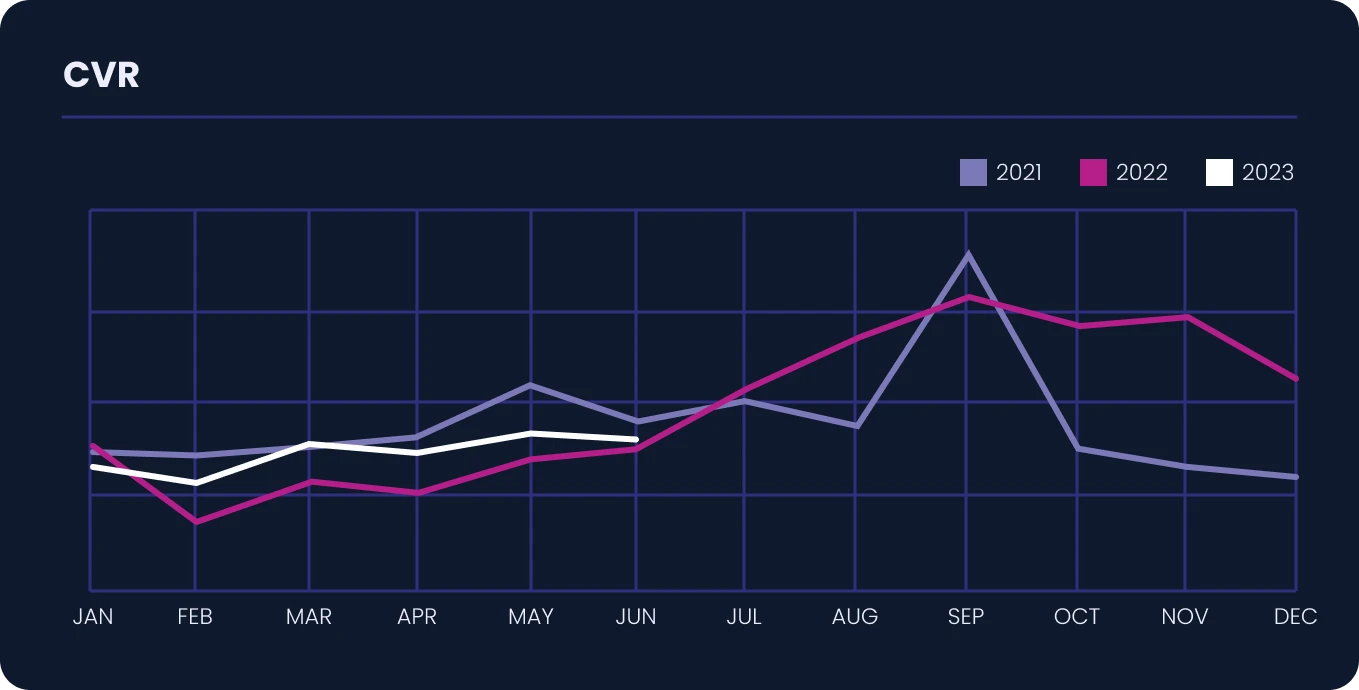

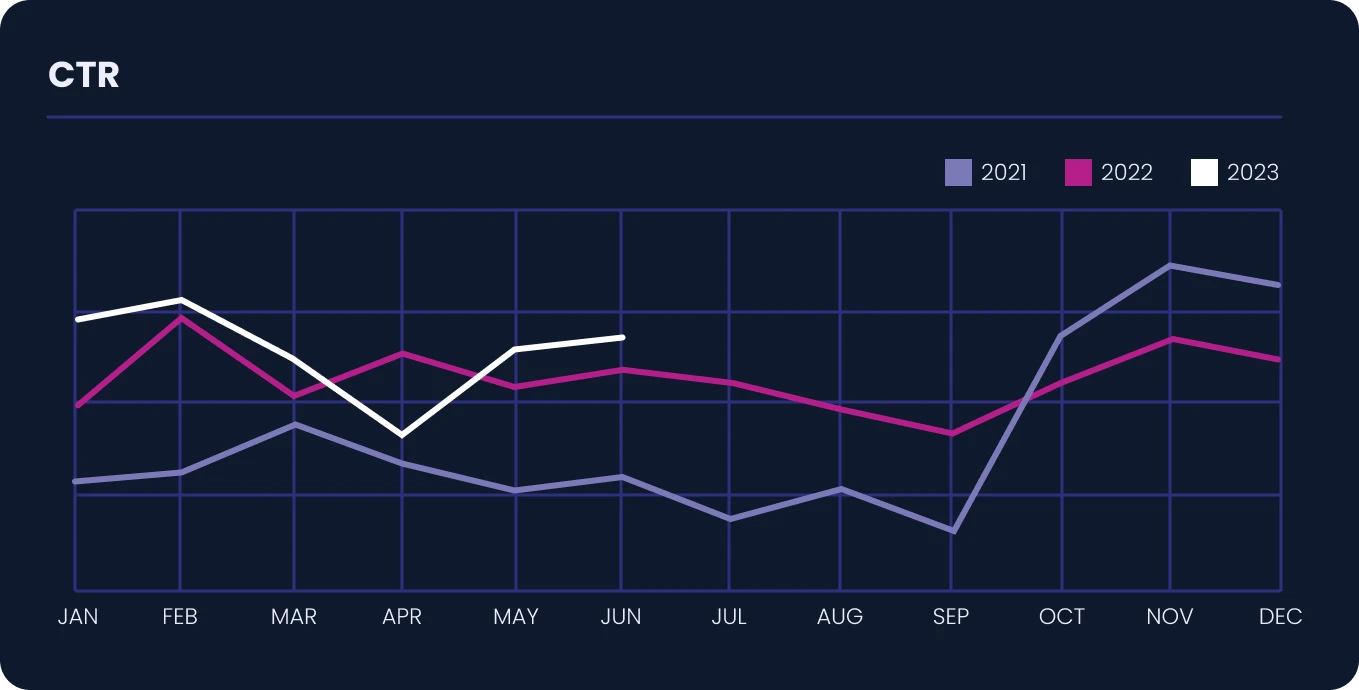

Analyzing the data spanning over two years, we see a vibrant and interconnected ecosystem of variables at play. Key metrics such as CPM (Cost of Media), CPC (Cost per Click), CTR (Click-Through Rate), CPL (Cost per Lead), and CVR (Click-to-Lead Conversion Rate) have all exhibited intriguing patterns.

KEY TAKEAWAY

The observation of a consistent decrease in CPC and CPL from mid-2022 onwards signals a more cost-efficient advertising landscape, with high buyer and seller interest.

Interest is arguably showing higher in Q2 of 2023 relative to the same time in 2021, since costs are roughly the same but demand signals evidenced by the lower CPC and CPL are better. Over Q1 and Q2 2023, these metrics have remained consistently low and flat, thereby indicating digital channels like Meta are a place for real estate marketers to maximize value for each advertising dollar invested.

KEY TAKEAWAY

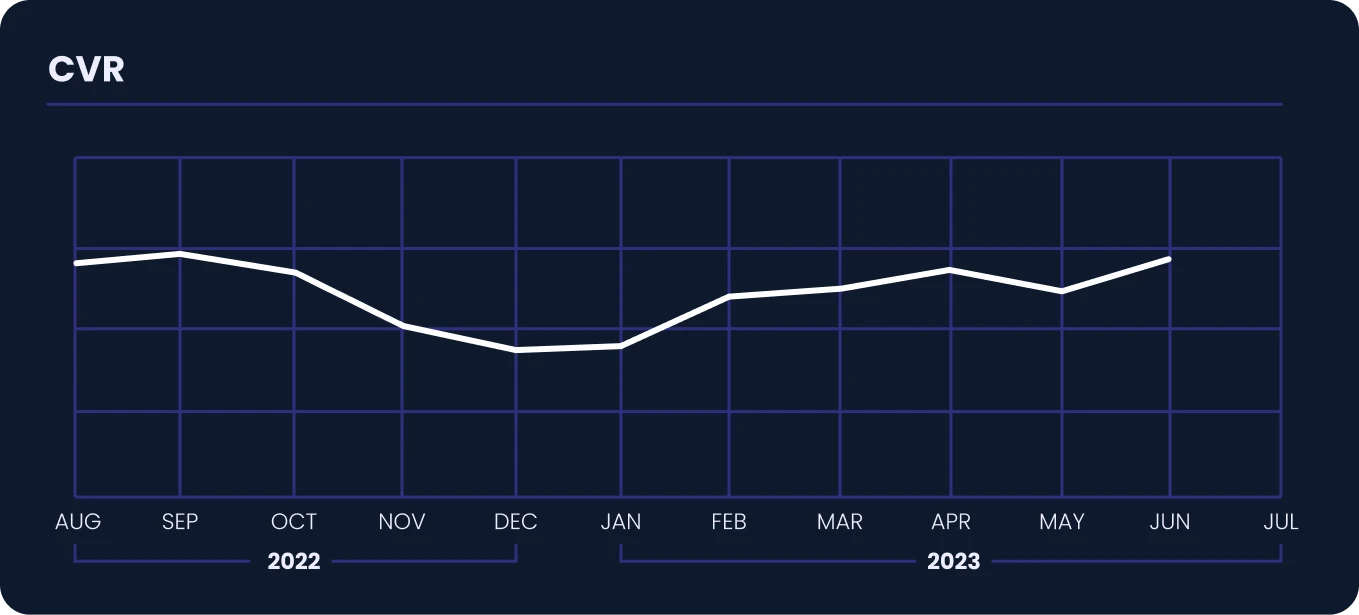

Regarding lead generation, a noteworthy increase of 10% is visible in the CVR over Q1 2023. This could be expected as we head into the busy season, as prospective buyers and sellers are increasingly willing to give their information.

Market demand and user engagement

KEY TAKEAWAY

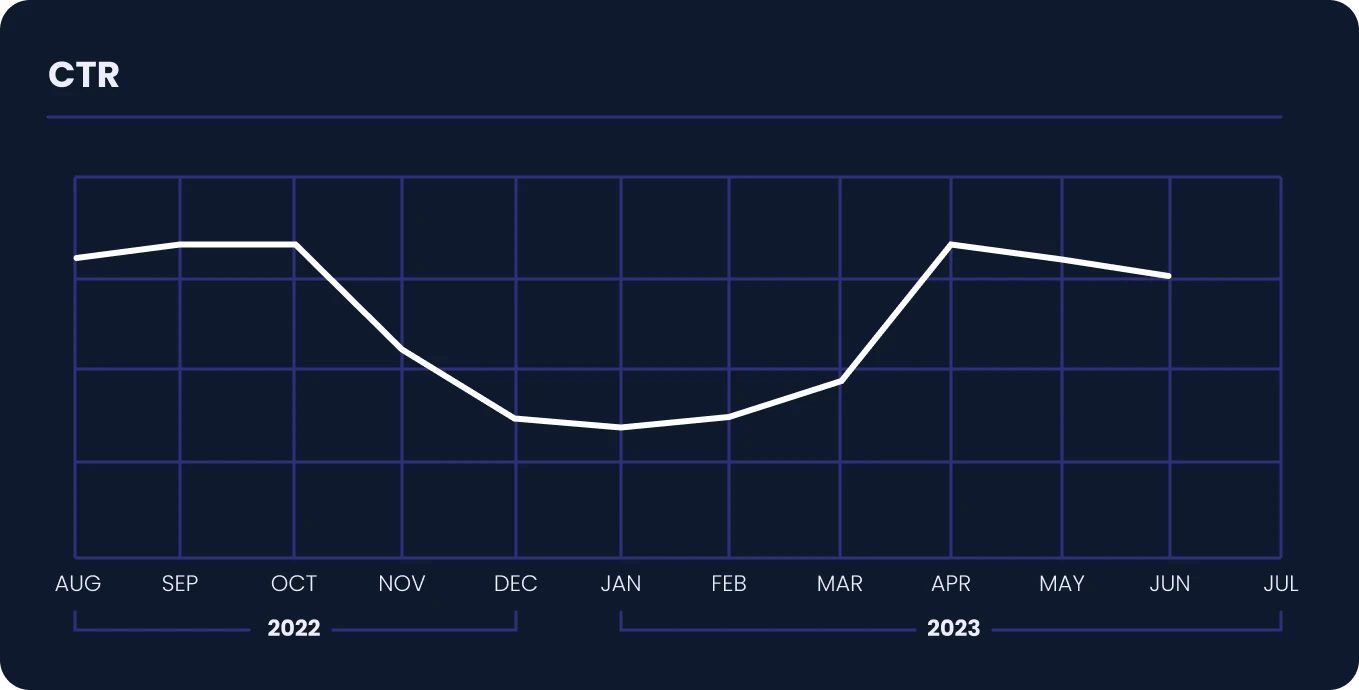

This analysis highlights early signs of the uptick in market interest and a rise in consumer engagement. Additionally, the sustained growth trajectory of the Click-Through Rate (CTR) indicates continued interest from prospective home buyers and sellers rather than just browsers. Agents should explore leveraging this interest by curating engaging and interactive content to appeal to both buyers and sellers.

Annualized advertising trends

Key metrics such as CPC (Cost per Click), CTR (Click-Through Rate), CPL (Cost per Lead), and CVR (Click-to-Lead Conversion Rate) have all exhibited intriguing patterns across Google as well.

KEY TAKEAWAY

As more agents leverage Google to capture high-intent seasonal search demand, advertising costs across the platform increase. The observation of an increase in CPC and CPL from Q1 to Q2 signals a more in-demand advertising landscape, as we head into the busy season.

KEY TAKEAWAY

Because prospective buyers and sellers actively search for specifics on Google, it is a high-intent platform. A CVR increasing 11.2% QoQ indicates an increased willingness of buyers and sellers to give their information rather than just browsing, making Google another place for real estate marketers to maximize value for each advertising dollar invested.

Market demand and user engagement

KEY TAKEAWAY

This analysis also highlights signs of an uptick in market interest and a rise in consumer engagement. Because Google is such a high-intent platform, an uptick in Click-Through Rate (CTR) during this time period aligns with expectations of an increase in interest from prospective home buyers and sellers, as the market heads into its busy season. Agents should explore leveraging this increase in high-intent interest during the busy season to engage with both buyers and sellers, as the likelihood of their competition doing so is also greater during this time.

Key takeaways

Optimal advertising spend

Improving Cost per Click (CPC) and Cost per Lead (CPL) between Q1 2022 and Q2 2023 underline increasing cost-efficiency for advertising on Meta platforms. However, CPC did not see the expected seasonal uptick in Q2, but instead remained relatively flat. CPC decreased 20.5% year over year in Q2 2023, and CPL fell 28.6% during the same period.

Across Google from Q1 2023 to Q2 2023, CPC increased 17.3%, indicating increased competition within the industry on Google. During the same time period, CPL only increased 7.8%. This indicates that, while the cost of advertising on Google has increased, we’re seeing higher than normal conversation from click to lead during this period. As we’ve seen in past periods, this is a broad indicator of continued demand from home buyers and sellers.

Effective lead generation

The comparison between Q2 2022 and Q2 2023 shows a steady, but slowing rise in Click-to-Lead Conversion Rate (CVR), showcasing Meta platforms’ effectiveness in attracting home buyer and seller leads. Specifically, CVR saw a 12.5% YoY increase in Q2, but a slightly lower QoQ increase of 9.9%. CVR increased QoQ by 11.2% across Google Search. This signifies that home buyers and sellers remain serious about connecting to get more information about home listings that are on the market and are, on average, increasingly willing to provide their contact information to Agents.

Home buyer interest & intent

A Click-Through Rate (CTR) that’s only slightly fallen from 6.39% in Q2 2022 to 6.27% in Q2 2023 indicates sustained interest and continued signs of strong home buyer demand. However, since last quarter, CTR has seen a 12.6% drop, mainly due to a slow April with May and June increasing with the trend of two previous years. Across Google Search, CTR saw a QoQ increase of 101%, indicating a high level of interest and intent amongst buyers and sellers searching for specific, targeted information. Real estate marketers who prioritize investment in expanding their databases and building traffic to their websites now may benefit disproportionately when home listings availability expands to meet possible latent, building, buyer demand.

Conclusion

Analyzing the Q2 2023 data, it’s evident that both Google and Meta platforms continue to offer significant potential for real estate professionals. These platforms are essential conduits for connecting with potential home buyers and sellers, growing Agents’ CRM databases and spheres, nurturing high-quality leads, and propelling business growth.

In particular, the Q2 2023 data highlights a continued level of engagement carried over from Q1, as well as cost-efficiency on Google and Meta platforms. At the same time, the consistently low and flat CPC and CPL on Meta, along with the increase in CVR across both Meta and Google, indicates that advertising on these platforms has become an economical and effective choice for real estate marketers, providing a greater return on investment for the advertising dollar.

Additionally, The notable increase in the click-to-lead conversion rate (CVR) during Q2 2023 stands as a testament to the efficiency of both the Google and Meta platforms in lead generation, even amidst a tough market landscape. This may also signal latent demand from more serious home buyers as conditions stabilize. This particular data point has consistently served as a preliminary indicator of demand over the past five years. Its prominence was especially noted in the spring of 2020, during the onset of COVID-19, a period of high uncertainty for the Real Estate industry regarding the pandemic’s potential impact on housing.

“In the current climate of fluctuating market dynamics,” says Kevin Comisky, Lead Generation Product Manager at eXp Realty. “Google and Meta advertising trends for Q2 2023 suggest that now is a great time for agents to invest in engaging and growing their spheres. As Cost Per Click and Cost Per Lead dip while engagement remains robust, the timing seems right for real estate professionals to harness the power of digital marketing, and position themselves at the forefront of a possible wave of buyer interest.”

Leveraging these initial indicators of demand, we foresaw an extraordinary surge in home demand, which subsequently led to the observed housing boom. This trend merits close monitoring in the upcoming months. Fundamentally, this underscores the value of maintaining effective digital marketing strategies in enhancing prospective buyer and seller engagement for real estate professionals. Given the progressively favorable conditions, agents should capitalize on this opportunity and invest in expanding their spheres, if possible.

In summary, the Q2 2023 data underscores an optimistic future for the real estate industry. Should these data points hold, we believe home buyer demand is strong and ready to absorb increased inventory when it comes online. By effectively capitalizing on Google and Meta platforms, real estate professionals can strategically position themselves to capitalize on increasing market demand and generate meaningful business growth.

Methodology

The dataset used in this analysis includes over 1.2 billion ad impressions and behaviors that have generated over 4.5 million leads. Data in this report includes the results of program optimization strategies.

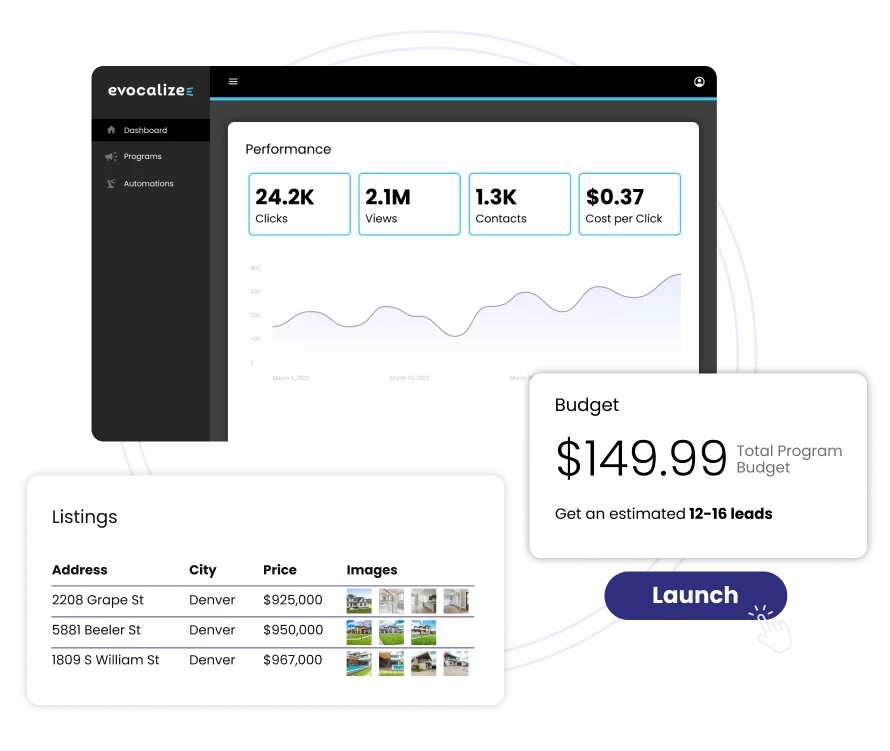

About Evocalize

“>Real estate’s leading brokerages, marketplaces, and CRMs use Evocalize to effortlessly create, manage, and optimize digital marketing campaigns.

Corporate marketing teams have full control over marketing strategies, branding, and messaging while benefiting from localization and automation. Without any digital marketing expertise, any agent can launch an ad. It’s push-button easy.

Evocalize is a partner in Meta’s Real Estate Top Provider Initiative and is a recipient of HousingWire’s Real Estate Top Tech 100 Award. Evocalize clients have helped their offices, agents and users generate more than 12 million leads.

If you’d like to drive even better business results from your marketing with automated, simple, and efficient real estate marketing programs on Facebook, Instagram, Google, and other online channels, contact us at [email protected] or evocalize.com.

Share

Subscribe to our blog

Don’t miss a beat in the fast-changing local digital marketing landscape — sign up to stay ahead of the curve!