Top 5 data-driven ways to help get more leads for mortgage lenders

Share

Schedule a 30-min marketing strategy call with our team

Getting high-quality leads is crucial for driving growth in the competitive mortgage industry — especially since 51% of home-buyers found their home online. However, with rising interest rates and economic uncertainty, lead generation is proving to be more challenging than ever.

In this blog post, we will explore 5 data-driven strategies you can leverage to help get more leads for mortgage lenders even in these difficult conditions. By taking a targeted, insight-led approach, you can identify and nurture the most promising leads, saving time and resources while boosting conversions.

1. CRM systems

Staying ahead demands more than just acquiring leads — it requires an efficient and organized approach to lead management. Enter Customer Relationship Management (CRM) systems, a game-changer that can amplify your lead-generation efforts and drive conversions. Let’s explore how leveraging a CRM system can take your mortgage marketing strategies to the next level and help you get more leads for mortgage lenders.

Leveraging CRM data for tailored marketing strategies

To be truly effective, a CRM system must be seen as more than just a storage facility for contacts. It’s a dynamic tool that, when harnessed correctly, can significantly impact your mortgage lead generation efforts.

Here’s how you can utilize CRM data to tailor marketing strategies for nurturing leads and driving conversions:

- Lead segmentation: Leverage CRM data to segment leads based on various criteria such as location, loan preferences, or engagement history. This allows you to send highly targeted and relevant content to each segment, increasing engagement and conversions.

- Automated workflows: Set up automated workflows triggered by specific actions or events in the CRM. For instance, automate follow-up emails or reminders for your team to contact leads who’ve shown interest in a particular mortgage product.

- Personalized communication: Utilize CRM insights to personalize your communication. Address leads by their names, reference their specific interests or inquiries, and showcase tailored solutions to their mortgage needs.

- Lead nurturing campaigns: Create automated drip campaigns based on lead behavior and interactions. Provide valuable mortgage insights, success stories, or updates about the industry to keep leads engaged and informed.

- Data analysis for strategy refinement: Regularly analyze CRM data to understand lead behavior patterns. Adjust your marketing strategies based on this analysis, optimizing your campaigns for better lead conversion rates.

By implementing these strategies and fully utilizing the capabilities of your CRM system, marketing teams and leadership can drive a surge of mortgage leads into your pipeline.

2. Search Engine Optimization (SEO) and content marketing

One of the most effective ways to reach potential lenders is by optimizing your online presence for search engines through Search Engine Optimization (SEO) and leveraging content marketing.

Search Engine Optimization, or SEO, is the cornerstone of digital visibility. When a potential client searches for services like yours, you want your website to appear at the top of search engine results. By optimizing your website for relevant keywords, especially targeting phrases like “mortgage lender near me” or “best lender in [City]”, you increase the likelihood of being found by individuals actively seeking mortgage solutions.

Keyword optimization:

- Conduct thorough keyword research to identify high-impact keywords related to the mortgage industry.

- Integrate these keywords strategically throughout your website content, meta descriptions, titles, and headers.

Content relevance and quality:

- Develop high-quality, informative content centered around these keywords. Content should resonate with your target audience, addressing their pain points and providing valuable insights into mortgage loans.

- Ensure the content is engaging, easy to comprehend, and actionable, positioning your organization as an authority within the mortgage industry.

Local SEO optimization:

- Tailor your SEO strategy to target local audiences by incorporating location-specific keywords and information relevant to the regions you operate in.

- Encourage reviews and testimonials from satisfied clients, contributing to improved local search rankings.

Actionable steps for your marketing team

- Collaborate with your SEO team to identify the most effective keywords.

- Work closely with content creators to develop compelling, keyword-rich content that resonates with the target audience and aligns with SEO goals.

- Implement a regular review process to analyze SEO performance, adjusting strategies to maintain optimal visibility and lead generation.

Incorporating these SEO strategies and producing relevant, high-quality content will position your organization favorably in search engine rankings, ultimately driving organic traffic and potential leads to your website.

3. Email marketing with segmentation

Effective communication with potential lenders is vital. Utilizing email marketing, especially when strategically segmented, can be a powerful tool to nurture and get more leads for mortgage lenders. This approach allows for personalized email campaigns based on recipient demographics and behaviors.

Segmentation for personalization:

- Divide your email list into specific segments based on criteria such as location, stage of the buying process, or engagement level.

- Tailor email content to resonate with each segment, addressing their unique needs and interests.

Behavioral triggers:

- Implement automation triggered by user behavior, like clicks, opens, or downloads.

- Deliver targeted content based on these behaviors to nurture leads effectively and guide them through the sales funnel.

Personalization at scale:

- Leverage dynamic content and personalization tokens to create personalized emails at scale.

- Address recipients by their names and provide content relevant to their interactions and preferences.

Actionable steps for your marketing team

- Data collection and management:

- Ensure compliance with data privacy regulations while collecting essential customer data.

- Leverage customer relationship management (CRM) systems to efficiently organize and manage collected data for email segmentation.

- Campaign setup:

- Collaborate with your email marketing team to set up automated email campaigns based on lead segments.

- Strategize email content, focusing on providing value and addressing the pain points of potential lenders.

- Internal alignment and feedback:

- Engage with your organization’s stakeholders to align email marketing goals with broader business objectives.

- Seek feedback from sales and customer service teams to continually refine and optimize email strategies for lead generation.

Effectively utilizing email marketing with segmentation not only enhances lead nurturing but also significantly improves lead conversion rates. By personalizing content and automating campaigns based on recipient behaviors, mortgage lenders can enhance engagement and drive potential lenders to take desired actions.

4. Social media engagement and advertising

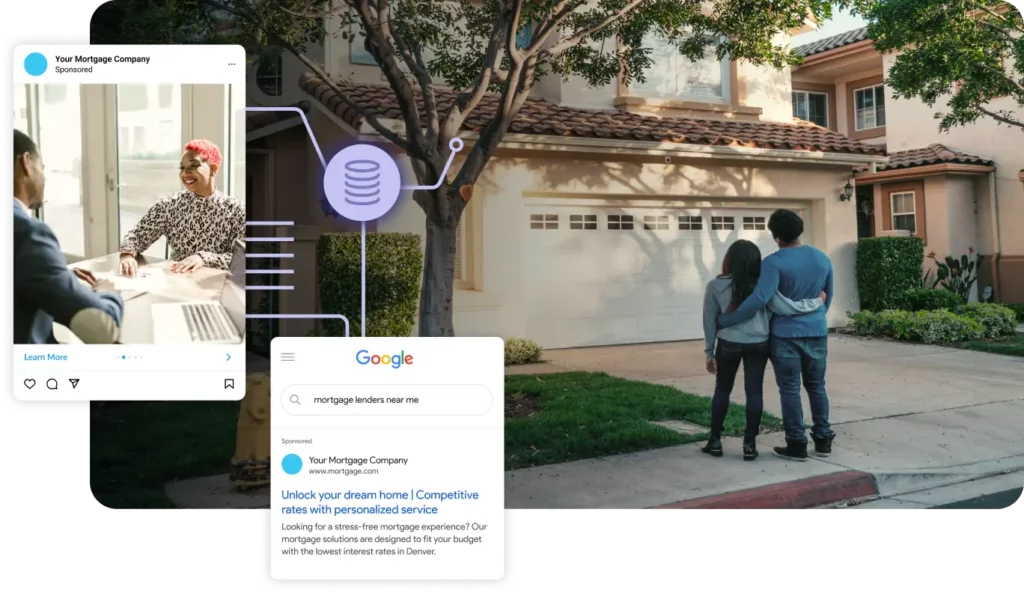

In the quest to get more leads for mortgage lenders, utilizing social media engagement and advertising emerges as a potent strategy. Evocalize, with its advanced algorithms and AI-powered insights, can be your trusted ally in this digital journey.

Engaging your audience through strategic content

Crafting content that resonates with your audience is the cornerstone of effective social media engagement. Beyond informative posts, consider creating in-depth mortgage-related guides, insightful infographics, and interactive Q&A sessions. Encourage audience participation by posing thought-provoking questions or asking for opinions on current industry trends. By consistently providing value and engagement, you establish your brand as an authority in the mortgage space.

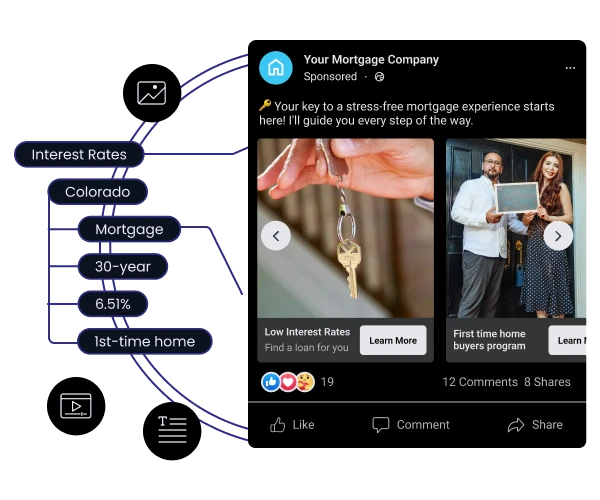

Leveraging the precision of targeted social media advertising

Use data analytics to identify specific demographics, behaviors, and interests of potential mortgage leads. Evocalize’s expertise in this domain can help fine-tune your campaigns, ensuring they reach the right audience. By aligning your message with their needs, you increase your chances to get more leads for mortgage lenders.

Actionable steps for your marketing team

Empower your marketing team with these actionable steps to optimize your social media advertising strategy and ultimately get more leads for mortgage lenders:

- Data-driven insights: Utilize data analytics to extract meaningful insights from your past campaigns and customer interactions. Tailor your content and ad strategy based on these insights.

- Strategic audience segmentation: Segment your audience based on key criteria such as demographics, behavior, and preferences. Craft personalized messages to address the specific pain points of each segment.

- Sophisticated campaign setup: Capitalize on Evocalize’s sophisticated platform for seamless campaign setup. Utilize it to distribute ads across multiple platforms at once to determine where to get more leads for mortgage lenders.

- Performance optimization: Continuously monitor and analyze campaign performance. Evocalize’s machine learning capabilities enable real-time optimizations, ensuring optimal outcomes and a steady stream of potential mortgage leads.

By implementing these strategies, marketing teams and leadership can unlock the potential of social media engagement and targeted advertising to get more leads for mortgage lenders.

Examples

Engagement strategies:

- Pose questions to followers about their mortgage goals and experiences, encouraging them to share their thoughts and generate discussion.

- Share success stories of clients who secured their dream homes through your mortgage services, showcasing the positive outcomes.

- Conduct live Q&A sessions where your audience can ask mortgage-related questions and receive immediate expert advice.

- Run mortgage-related polls or surveys to gather insights into the preferences and concerns of your target audience.

Advertising tactics to get more leads for mortgage lenders:

- Create visually appealing infographics explaining various mortgage options and terms to educate and engage the audience.

- Use carousel ads to showcase a series of images highlighting the steps involved in the mortgage application process, simplifying it for potential clients.

- Utilize short video ads featuring satisfied clients sharing their home-buying journey with your assistance.

- Leverage retargeting ads to reach individuals who have visited your website but haven’t taken any action, providing them with compelling offers or valuable mortgage insights.

- Create ads specifically tailored to different demographics, such as first-time homebuyers, retirees looking to downsize, or investors seeking real estate opportunities.

Content ideas for social media:

- Share blog posts or articles on tips for improving credit scores to enhance mortgage eligibility, demonstrating your expertise.

- Create short video explainers on different types of mortgages, breaking down complex concepts into easy-to-understand snippets.

- Share local real estate market updates and trends, connecting them to potential mortgage opportunities.

- Highlight testimonials from satisfied customers, showcasing their positive experiences working with your mortgage services.

5. Data-driven landing pages and A/B testing

When it comes to enticing potential mortgage leads and converting them into valuable clients, landing pages play a pivotal role. However, not just any landing page will do the trick. Crafting a high-converting landing page involves a strategic blend of design, content, and data-driven insights.

In this section, we’ll delve into the significance of designing landing pages based on data insights and how A/B testing can refine your approach to achieve the ultimate goal to get more leads for mortgage lenders.

The power of data-driven landing pages

Data insights should be at the heart of your landing page strategy. They unveil valuable information about user behavior, preferences, and pain points. By incorporating these insights into your landing page design, you can tailor the user experience to maximize lead conversion.

- Responsive design: Analyze data to understand the devices your audience uses most to access your landing pages. Optimize your landing pages to be responsive and provide a seamless experience across various devices—desktops, tablets, and smartphones.

- Content placement and hierarchy: Use data to determine the optimal placement of key elements on your landing page. Whether it’s the CTA button, form, or crucial information, data can guide you in arranging these elements for enhanced visibility and engagement.

- A/B testing for continuous improvement: Regularly conduct A/B tests to experiment with different elements such as headlines, images, forms, or colors. Analyze the results to make data-driven decisions and refine your landing pages for better performance.

Expert tips for taking A/B testing to the next level

While you may already have experience with A/B testing, here are some expert tips to elevate your strategy:

- Micro-conversions analysis: Beyond tracking macro-conversions (completed forms), analyze micro-conversions (engagement actions like clicks and scroll depth). These insights can guide you in optimizing for more meaningful interactions.

- Behavior flow mapping: Use tools like heatmaps and session recordings to map the behavior flow of users on your landing pages. Understand where they click, what they ignore, and what captures their attention. Adjust your design and layout accordingly.

- Personalization testing: Experiment with personalizing your landing page content based on user segments. Tailor headlines, images, or offers to match the specific needs and preferences of different audiences for increased engagement and conversion rates.

- Emotion elicitation testing: Experiment with the emotional triggers in your copy and design. Test variations that evoke trust, urgency, excitement, or curiosity to identify the most effective emotional appeal for your audience.

By infusing data-driven insights into your landing page design and employing advanced A/B testing techniques, you can significantly elevate your lead conversion rates to get more leads for mortgage lenders.

Get more leads for mortgage lenders

Getting more high-quality leads is essential for driving growth and staying competitive in today’s mortgage industry landscape. By taking a data-driven approach and leveraging tactics like CRM optimization, social media advertising, email marketing with segmentation, and advanced landing page testing, mortgage lenders can build an effective system to attract and nurture promising leads. With strategic thinking and the right technology, you can overcome current challenges and propel your business growth through superior lead generation.

Share

Subscribe to our blog

Don’t miss a beat in the fast-changing local digital marketing landscape — sign up to stay ahead of the curve!